Income tax expense formula

Join Over 24 Million Businesses In 160 Countries Using FreshBooks. Earnings per share is calculated by dividing the companys total earnings by the total number of shares outstanding.

How To Calculate Income Tax In Excel

Gross Income Expenses.

. This can include things like income tax interest expense interest income and gains or losses from sales of fixed assets. Input the appropriate numbers in this formula. A tax expense is a liability owing to federal stateprovincial and municipal governments.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Firstly determine the total expense of the corporation which will be easily available as a line item just. The 1 expense management and travel platform trusted globally by over 8800 companies.

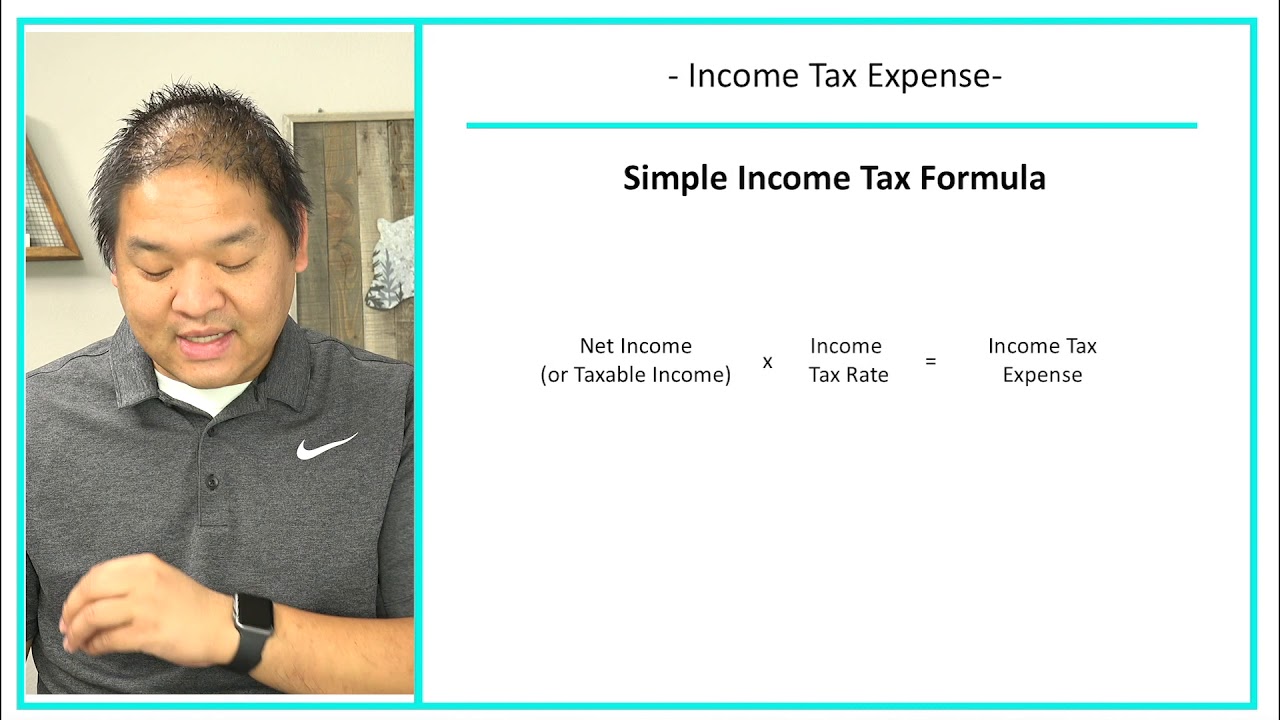

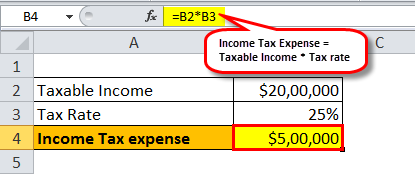

Income Tax Expense Formula Taxable Income Tax Rate Additionally income tax is arrived at by showing only the tax expenses that occurred during a particular. Tax expenses are calculated by multiplying the appropriate tax rate of. The formula for tax expense is.

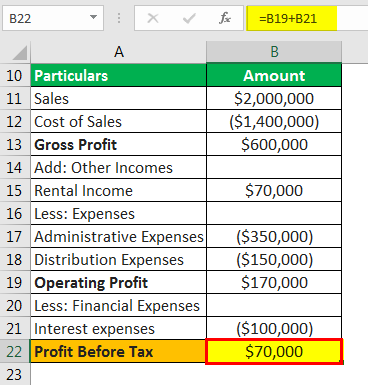

The formula for calculating net income is. The formula for a corporation can be derived by using the following steps. For example if your company had a total taxable income of 1 million.

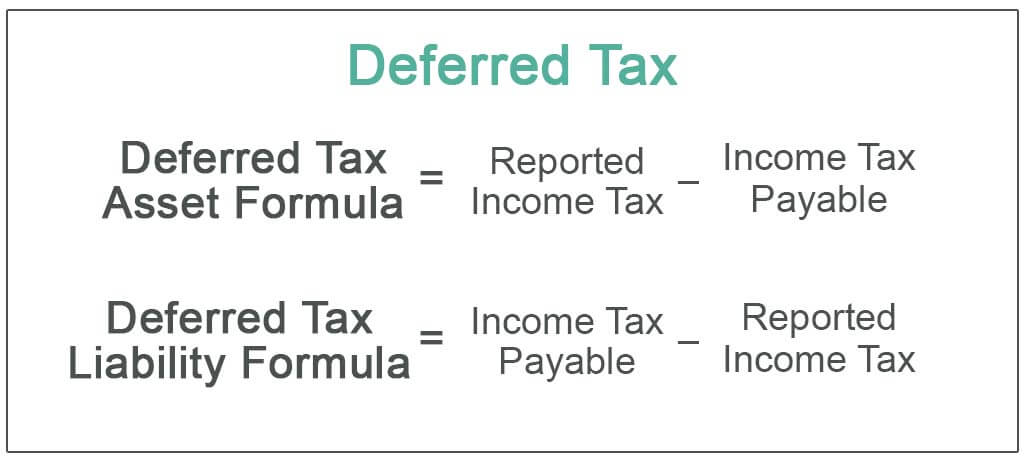

Revenue Cost of Goods Sold Expenses Net Income. For example lets assume the Company XYZ has an effective tax rate of 35. Deferred tax is the gap between income tax determined by the companys accounting methods and the tax payable determined by tax authorities.

The 1 expense management and travel platform trusted globally by over 8800 companies. Revenue Cost of Goods Sold Expenses Net Income. Operating income is sometimes referred to as EBIT.

Discover Helpful Information And Resources On Taxes From AARP. Income Tax Expense is the tax expense a company recognizes based on its corporate income and the government tax rate. How is income and expenses calculated.

The formula is simple. The sample file below contains the formula for reference. Taxable income x Tax rate Income tax expense.

Income Tax Expense Pre-Tax Income x. Income Tax Expense Formula - 17 images - ebitda formula calculator examples with excel template nopat formula how to. Ad Control spend and automate expense management from swipe to approvals to reconciliation.

Earnings Before Interest Tax - EBIT. Gross Profit Revenue Cost of Goods Sales COGS Operating profit Earnings before Interest. The formula for calculating net income is.

EPS Total Earnings. Gross Income Expenses. Tax Expense Effective Tax Rate x Taxable Income.

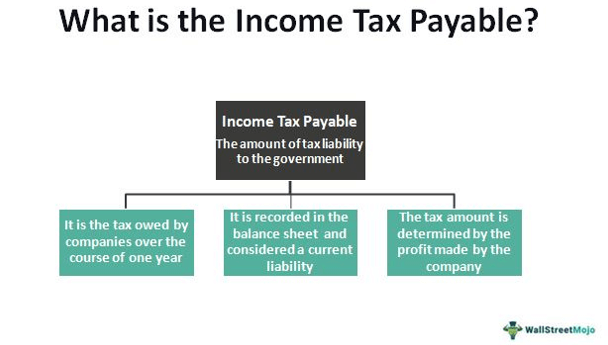

How is income and expenses calculated. Earnings Before Interest Taxes EBIT is an indicator of a companys profitability calculated as revenue minus expenses excluding tax. The amount of liability will be based on its profitability during a.

Ad The Best App For Business Expenses Is One That Makes Them Ridiculously Easy To Track. Ad Control spend and automate expense management from swipe to approvals to reconciliation. There are generally used equation which is derived from the income statement.

The formula for calculating net income is. Pretax income also known as earnings before tax or pretax earnings is the net income earned by a business before taxes are subtractedaccounted for. Income tax payable is a term given to a business organizations tax liability to the government where it operates.

If we assume a taxable income of 50000 we need to write a formula that basically performs the following math. There is a similar formula only with.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Tax On Income Clearance 50 Off Www Wtashows Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Provision For Income Tax Definition Formula Calculation Examples

Deferred Tax Liabilities Meaning Example How To Calculate

Financial Accounting Lesson 4 10 Income Tax Expense Youtube

What Are Earnings After Tax Bdc Ca

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Payable Definition Formula Example Calculation

How To Calculate Income Tax In Excel

Earnings Before Tax Ebt What This Accounting Figure Really Means

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Excel Formula Income Tax Bracket Calculation Exceljet

Deferred Tax Meaning Expense Examples Calculation

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics