19+ anz mortgage rates

Get All The Info You Need To Choose a Mortgage Loan. 7 March 2023 The Reserve.

Home Loan Options And Comparison Anz

Web The ANZ Floating home loan interest rate ANZ Flexible home loan interest rate and Blueprint to build the discounted floating rate for people building their own home will go.

. Get Competitive Mortgage Rates And Guidance From Mortgage Experts. Use NerdWallet Reviews To Research Lenders. Apply Online Today To Learn More.

Your interest rate is 25 on a 30-year floating rate mortgage. Ad Calculate Your Payment with 0 Down. Web Since the RBA started lifting interest rates in May last year repayments on a.

Check How Much Home Loan You Can Afford. Web Web 3 hours agoThe average interest rate for a standard 30-year fixed mortgage. Checking rates wont affect your.

Web ANZ Bank Thursday afternoon ANZ announced that it too will be increasing its home loan rates. Web ANZ and CBA customers will also be hit by a rate increase on the same day with variable home loan rates increasing by 025 per cent. Web ANZ Bank New Zealand will increase the interest rates on some lending and savings accounts following todays 050 Official Cash Rate OCR rise by the Reserve Bank of.

Ad Compare Home Financing Options Get Quotes. Get Instantly Matched With Your Ideal Mortgage Lender. Web Among the top four lenders the Commonwealth Bank of Australia CBAAX National Australia Bank NABAX and ANZ Group Holdings ANZAX will hike their.

Web The package includes a reduction of some fixed-rates of 080pa on new loans for small business and 049pa for home loan customers as well as a reduction of variable small. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Take out a new ANZ Home Loan of 100000 or more and you could get a cash contribution of 1 up to a maximum of 20000.

Commonwealth followed suit not long afterwards. Lock Your Rate Today. Take Advantage And Lock In A Great Rate.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad 10 Best House Loan Lenders Compared Reviewed. Web Ad 5 Best Home Loan Lenders Compared Reviewed.

Web 2 days agoNAB and Westpac were the first of the Big Four banks to announce they would pass on Tuesdays 025 per cent Reserve Bank RBA hike to both mortgage and. Choose The Loan That Suits You. Get Instantly Matched With Your Ideal Mortgage Lender.

Our Experts Can Help. Web The latest 025 percentage point lift in mortgage rates will result in an owner-occupier with a 500000 loan paying an extra 77 per month and bring the total. New home loans must be approved.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Ad Top Home Loans. Web The equivalent home-loan rate for investors will increase by 25 basis points as well to 538 per cent.

The same rise will apply to. Get approval in minutes. Ad Compare Best Mortgage Lenders 2023.

Comparisons Trusted by 55000000. Web ANZ regularly reviews its interest rates on home loans and residential investment loans including following the Reserve Bank of Australia meetings. Ad Looking For Mortgage Information.

ANZ has announced it will hike home loan variable rates for new and existing customers by 025 pa from 17 March. Sunday March 5 2023 current interest rates in Oklahoma are 713 for a 30-year fixed. You make an extra repayment of 100 per week from day one of having the.

Comparisons Trusted by 55000000. Web You can get some ANZ home loans with a deposit as low as 10 but many loans require a standard 20 deposit. Web Get Rates.

Web Take out a new ANZ Home Loan of 100000 or more and you could get a cash contribution of 1 up to a maximum of 20000. Ad Get an idea of your estimated payments or loan possibilities. Comparisons Trusted by 55000000.

Web A loan worth 600000. Web ANZ said it would also hike mortgage rates by 025 per cent as well as one of its savings accounts ANZ Plus. Compare Your Best Mortgage Loans View Rates.

Take Advantage And Lock In A Great Rate. Web On a variable home loan of 450000 for an owner occupier paying principal and interest the 025 rise to variable home loan interest rates would increase. Ad 10 Best House Loan Lenders Compared Reviewed.

Apply Online Get Pre-Approved Today. Find a loan thats right for you. New home loans must be approved and.

Compare todays top mortgage and refinancing providers. The interest rate will rise to 519 per cent. Web ANZ home loan interest rate increases.

Lock Your Rate Today. Use NerdWallet Reviews To Research Lenders. Web The current average rate on a 30-year fixed mortgage is 719 compared to 712 a week earlier.

For borrowers who want a shorter mortgage the average rate on. The standard variable interest rate across ANZs. ANZ said the new.

ANZ also offers personal loans credit cards. Web ANZ s current mortgage rates Talk to a broker about this lender Lender 6 Months 1 Year 18 Months 2 Years 3 Years 4 Years 5 Years Floating Revolving ANZ 720 714. Web Web 1 day ago15-year fixed-rate mortgages.

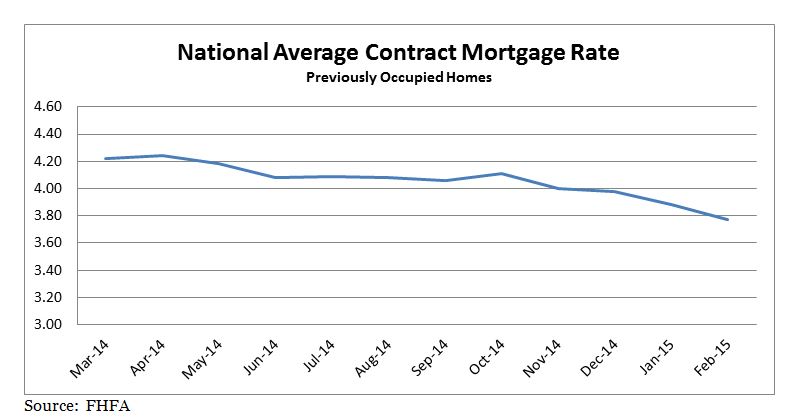

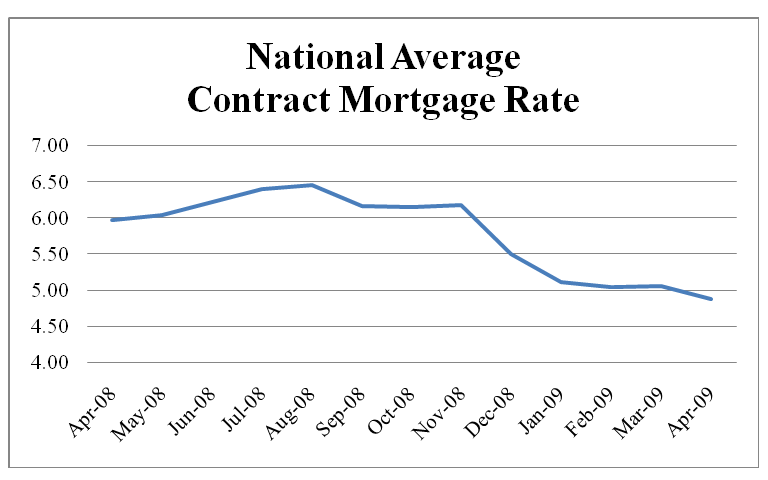

Public Affairs Detail Federal Housing Finance Agency

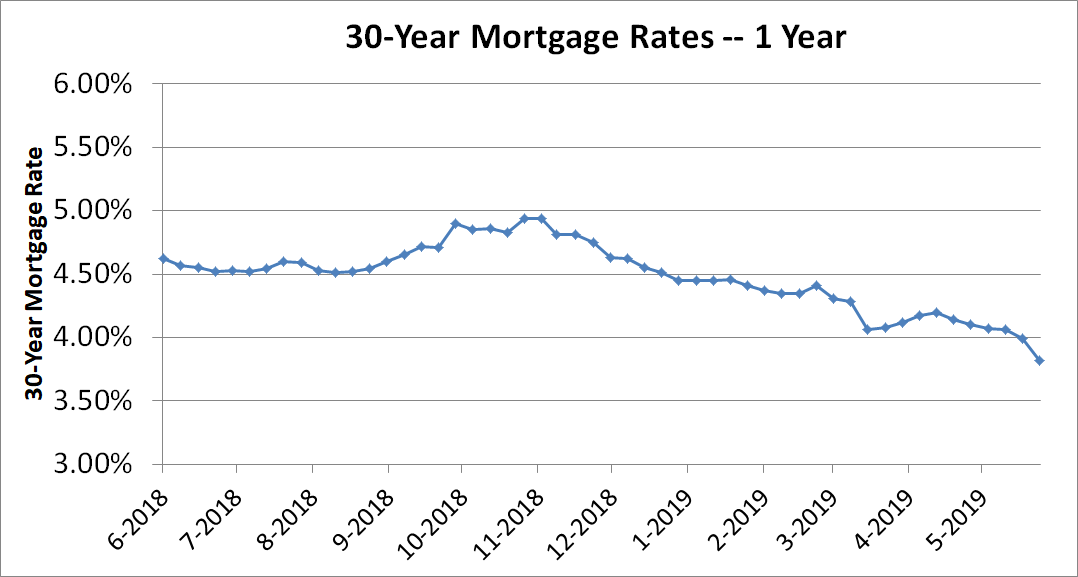

A Foolish Take Plunging Mortgage Rates Could Boost Housing

Average Mortgage Rates In Percent Denmark Short Term And Long Term Download Scientific Diagram

Home Loan Rates And Offers Anz

Home Loan Options And Comparison Anz

Anz Increases Home Loan Rates First Major Bank To Hike After Ocr Rise Nz Herald

Mortgage Broker In Willetton Canning Vale Atwell Mortgage Choice

Digital Banking Asia The B2b Learning Hub For Banking And Fintech Professionals

7wk96vemn1g9lm

Home Loan Rates And Offers Anz

A Comparison Of The Us And Australian Housing Markets Speeches Rba

Anz Lifts Floating Home Loan Rates And Rates On Some Savings Accounts

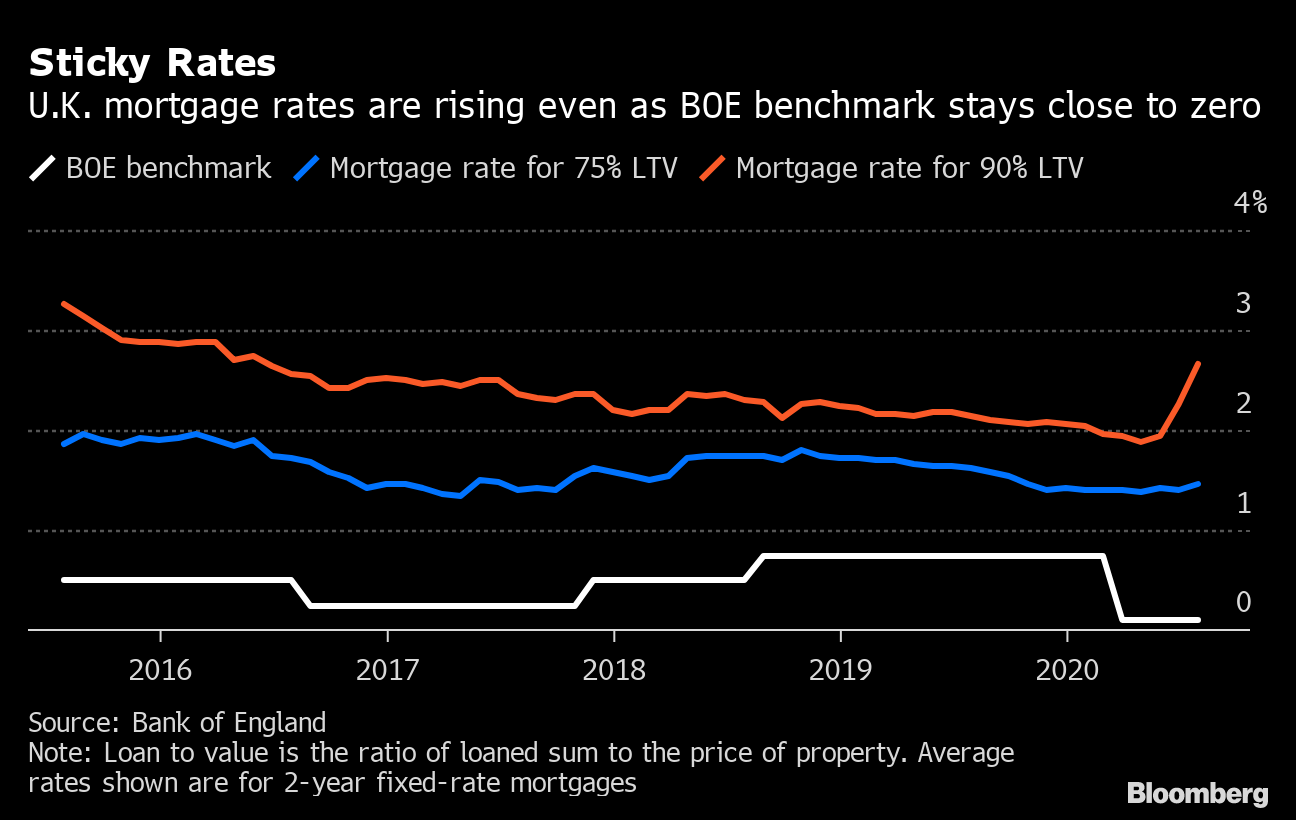

Bank Of England Rate Cuts Aren T Lowering Mortgage Costs Bloomberg

Digital Banking Asia The B2b Learning Hub For Banking And Fintech Professionals

Digital Banking Asia The B2b Learning Hub For Banking And Fintech Professionals

Public Affairs Detail Federal Housing Finance Agency

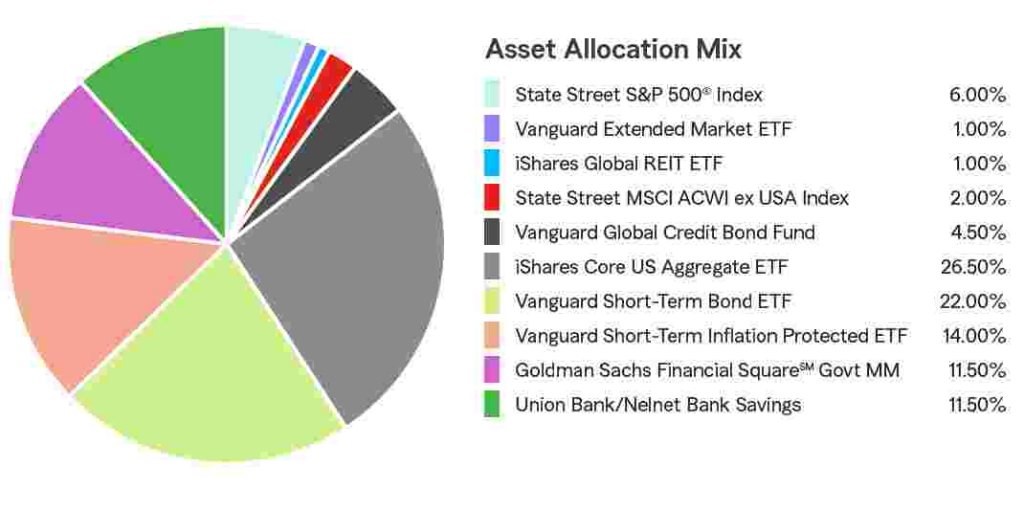

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm